OLDER HOMES CAN BE CHALLENGING SOMETIMES…

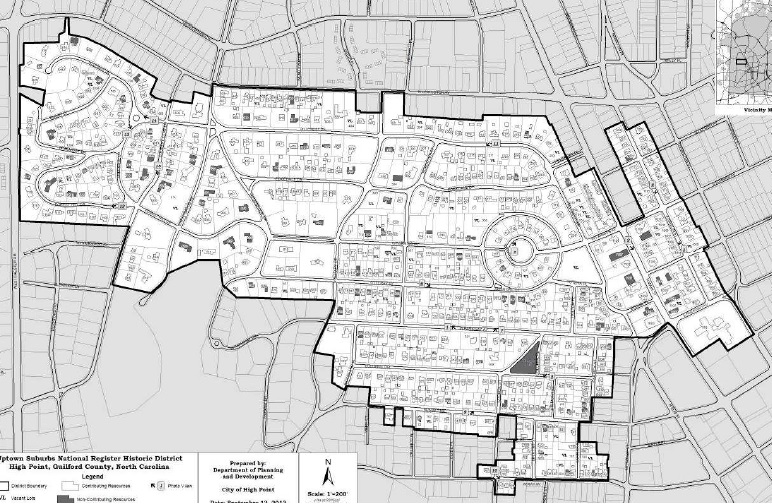

repairs, renovations and updates. But what if you could get a tax credit for a portion of your expenses? Guess what, it just so happens that you can! There is an overlay district in High Point, the ‘Uptown Historic District’ which covers much of “Emerywood” and the Johnson Street Historic District. I recently mailed a postcard to homes that are considered conforming in this district, which make them eligible for tax credits.

North Carolina’s State Historic Rehabilitation Tax Credit Program provides jobs, bolsters the tax base, and revitalizes existing buildings and infrastructure, while preserving the state’s priceless historic character. This program administered by the State Historic Preservation Office, encourages the conservation of North Carolina’s historic resources. Homeowners may receive a 15% state tax credit for qualified rehabilitation of owner-occupied residential properties.

HISTORIC PRESERVATION REHABILITATION TAX CREDITS ELIGIBILITY:

- Properties listed in the National Register of Historic Places, either individually or as a contributing building in a National Register historic district are candidates.

- Available credit equals 15% of eligible rehabilitation expenses up to project cap.

- Project minimum threshold is $10,000 in rehabilitation expenses.

- Project cap limits eligible rehabilitation expenses to $150,000 – maximum credit is $22,500.

- Eligible rehabilitation expenses must be incurred within any 24 month period, though the overall project may take longer than 24 months.

- Credit may be taken in year structure placed in service and carried forward for nine years.

- Credits may be transferred with property so long as transfer of property occurs before it is placed in service.

- Taxpayer is allowed to claim credits for a rehabilitation once every five years.

- New credit effective January 1, 2016, sunsets January 1, 2020.

- Graduated fee schedule based on total rehabilitation expenses.

- All rehabilitation work must meet The Secretary of the Interior’s Standards for Rehabilitation.

- Regardless of total rehabilitation expenditure, the State Historic Preservation Office will review all work for compliance with the Standards.

- New credit effective January 1, 2016, sunsets January 1, 2020.

I wish they had this overlay in place when I remodeled my first house on Johnson Street, I would have hit the max in deductions! With my current home on Hillcrest Drive, my husband and I are taking full advantage. We received tax credits when we first purchased the home for exterior work and remodeling the master bathroom. Now we are embarking on a total kitchen remodel, where we once again will benefit. The tax credit is a nice pat on the back to homeowners for helping North Carolina retain its historic homes.